본문

Passage of Tax Amendment Bills by the National Assembly of South Korea

- Newsletters

- 2025.12.09

On December 2, 2025, the National Assembly passed 13 tax amendment bills. The legislative package includes significant revisions to the (i) Corporate Tax Act, (ii) Inheritance Tax and Gift Tax Act, (iii) Act on Restriction on Special Cases Concerning Taxation, (iv) Adjustment of International Taxes Act and (v) Education Tax Act.

The Corporate Tax Act has been amended to broaden income deductions available to investment companies and to clarify the taxable scope applicable to foreign corporations, with the overarching objectives of stimulating corporate investment and enhancing tax equity. The Inheritance Tax and Gift Tax Act has been revised to expand the breadth of taxable persons, while the Act on Restriction on Special Cases Concerning Taxation has been updated to incentivize dividend distribution, employment, and investment, collectively aimed at reinforcing corporate reinvestment and growth.

Further amendments to the Adjustment of International Taxes Act and the Education Tax Act have been introduced to facilitate compliance with the global minimum tax regime and to ensure stable funding for education, respectively, thereby supporting balanced improvements throughout the tax system.

In addition, the package of amended tax legislation includes notable changes such as strengthened support for childbirth and childcare, rationalized domestic taxation of overseas stock income under the Income Tax Act, enhanced anti-tax evasion measures under the Value-Added Tax Act and improved taxpayer convenience under the Framework Act on National Taxes.

Outlined below are the key contents and implications of the amendments.

1. Corporate Tax Act

2. Inheritance Tax and Gift Tax Act

3. The Act on Restriction on Special Cases Concerning Taxation

4. Adjustment of International Taxes Act

5. Education Tax Act

1. Corporate Tax Act

A. Amendments

• The scope of income deductions for securitization companies and similar entities has been broadened to now encompass special purpose companies (SPCs) established by venture investment funds. Additionally, under Article 51-2(1), (2) of the Corporate Tax Act, SPCs may benefit from income deductions even in benefit from income deductions even in cases).

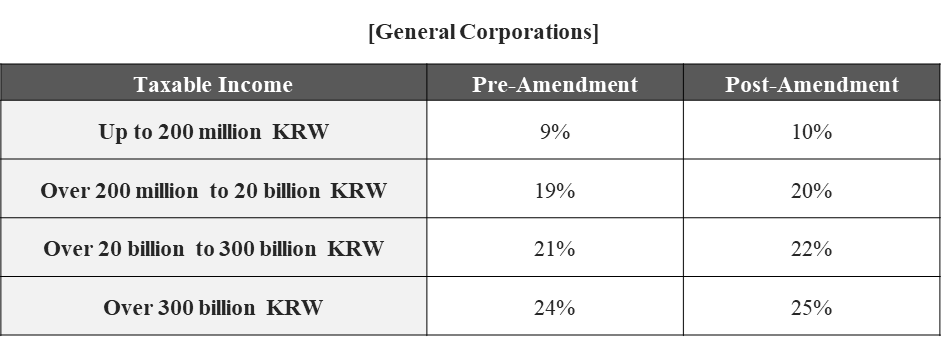

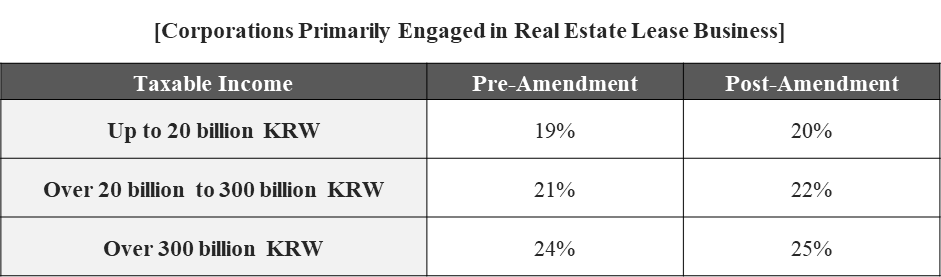

• The corporate tax rate has been increased by 1% across all each tax brackets, pursuant to Article 55(1) of the Corporate Tax Act.

• Dividend income from domestic sources for foreign corporations now encompasses dividend income received through over-the-counter derivative transactions. Additionally, the definition of “other income” (i.e., income arising from the receipt of assets located in Korea as a gift) has been expanded to include the difference between the consideration paid and the market value when a foreign corporation acquires assets at a significantly lower price. These amendments are stipulated under Article 93, Items 2 and 10 of the Corporate Tax Act.

B. Implications

While the increase in corporate tax rates is expected to raise the overall tax burdens for businesses, the amendments are also expected to encourage investment through SPCs and enhance tax equity regarding domestic source income of foreign corporations.

2. Inheritance Tax and Gift Tax Act

A. Amendments

• Where a profit-making corporation is designated as a beneficiary, the scope of inheritance tax liability has been broadened to include not only the heir’s spouse but also the spouses of the heir’s direct descendants among the corporation’s shareholders. This amendment is stipulated under Article 3-2 (2) of the Inheritance Tax and Gift Tax Act.

• Furthermore, when securities are transferred to a spouse or direct relative through an alternative trading system, such assets are now excluded from being presumed as gifts to the spouse or direct relative. These amendments are stipulated under Article 44 of the Inheritance Tax and Gift Tax Act.

B. Implications

• In light of the expanded scope of inheritance tax liability for profit-making corporations, existing tax planning strategies involving corporate bequests will require careful review and adjustment.

3. The Act on Restriction on Special Cases Concerning Taxation

A. Amendments

• Dividend income from high-dividend companies (as defined below) is excluded from global taxation and instead subject to separate taxation. These amendments are stipulated under Article 104-27 of the Act on Restriction on Special Cases Concerning Taxation.

– Applicable taxpayer: Shareholders (residents) of high-dividend listed companies. A "high-dividend listed company" is defined as a listed company that has not reduced dividends compared to the previous year and has either a dividend payout ratio of 40% or more, or a dividend payout ratio of at least 25% with a profit dividend increase of 10% or more.

– Applicable tax rates: A four-tier progressive tax rate system (tax base: up to 20 million KRW: 14%, up to 300 million KRW: 20%, up to 5 billion KRW: 25%, over 5 billion KRW: 30%).

• Dividend income and similar income received from investments in venture investment purpose companies through venture investment funds are exempt from taxation. These amendments are stipulated under Article 13 of the Act on Restriction on Special Cases Concerning Taxation.

• When a domestic corporation invests in a venture investment purpose company through a venture investment fund, and the venture investment purpose company subsequently acquires shares or equity interests in venture enterprises, 5% of the acquisition cost of such shares or equity interests may be deducted from the domestic corporation’s corporate income tax. This is provided for in Article 13-2(2) of the Act on Restriction on Special Cases Concerning Taxation.

• When a domestic corporation contributes land or buildings as in-kind capital to a project real estate investment company under the Real Estate Investment Company Act, the payment of capital gains tax or corporate tax is deferred until the domestic corporation disposes of the shares acquired via the in-kind contribution. This measure is prescribed by Article 97-9 of the Act on Restriction on Special Cases Concerning Taxation.

B. Implications

• The introduction of separate taxation on dividend income from high-dividend companies is expected to stimulate stock market activity. At the same time, detailed criteria, such as the calculation method for dividend payout ratios, especially in cases of net losses, will require further clarification during the subsequent legislative process. The revised tax incentives for venture investment are expected to broaden investment activity through investment purpose companies, and in-kind contributions to project real estate investment companies are likewise anticipated to increase.

4. Adjustment of International Taxes Act

A. Amendments

• The amount of Net GloBE Income used to calculate the domestic top-up tax is defined as the total GloBE Income of the local constituent entity, minus its total GloBE Losses. This is prescribed under Article 73-2 of the Adjustment of International Taxes Act.

• The effective tax rate for purposes of the domestic top-up tax is calculated by dividing the aggregate amount of Adjusted Covered Taxes of local constituent entities by the aggregate amount of their Net Globe Income for the relevant fiscal year. The determination of Adjusted Covered Taxes adheres to the methodology prescribed for the calculation of top-up tax, which is stipulated under Articles 73-3 to 73-5 of the Adjustment of International Taxes Act.

• The domestic top-up tax is determined as: [Minimum Rate (15%) – Effective Tax Rate of local constituent entities] × Domestic Excess Profit + Additional Current Domestic Top-up Tax (Article 73-6 of the Adjustment of International Taxes Act).

• Low-taxed local constituent entities are required to pay their allocated share of the domestic top-up tax. The allocation of the domestic top-up tax may be based on each entity’s contribution and financial capacity, or through mutual agreement among all local constituent entities of the MNE group, with the filing constituent entity electing the allocation method. This is stipulated under Article 73-7 of the Adjustment of International Taxes Act.

• The calculation and imposition of the domestic top-up tax incorporate the De Minimis Exclusion and Special Cases on Minority-Owned Constituent Entity, as provided under the OECD Pillar Two Model Rules, as prescribed in Articles 74 and 75 of the Adjustment of International Taxes Act.

• For local investment entities other than the ultimate parent entity, the domestic top-up tax is calculated independently from the general domestic top-up tax of the MNE group. This amendment is stipulated under Article 79 of the Adjustment of International Taxes Act.

B. Implications

• The amendments are expected to strengthen the domestic tax base by securing taxing rights over low-taxed local entities within the framework of the global minimum tax regime.

5. Education Tax Act

A. Amendments

• A new tax bracket has been introduced under the Education Tax Act, increasing the tax rate from 0.5% to 1% for tax bases exceeding KRW 1 trillion as prescribed under Article 5(1) of the Education Tax Act.

B. Implications

• The introduction of the new tax bracket and the accompanying increase in the tax rate are expected to impose higher tax burdens on major financial institutions.

The Tax Group of Yoon & Yang LLC provides premier one-stop total services in the fields of tax advisory and litigation. For a wide range of clients' economic activities, the group offers proactive tax plans and response strategies designed to maximize tax savings and minimize tax risk, delivering services best suited for a rapidly changing environment.

- Practice Areas

- #Tax